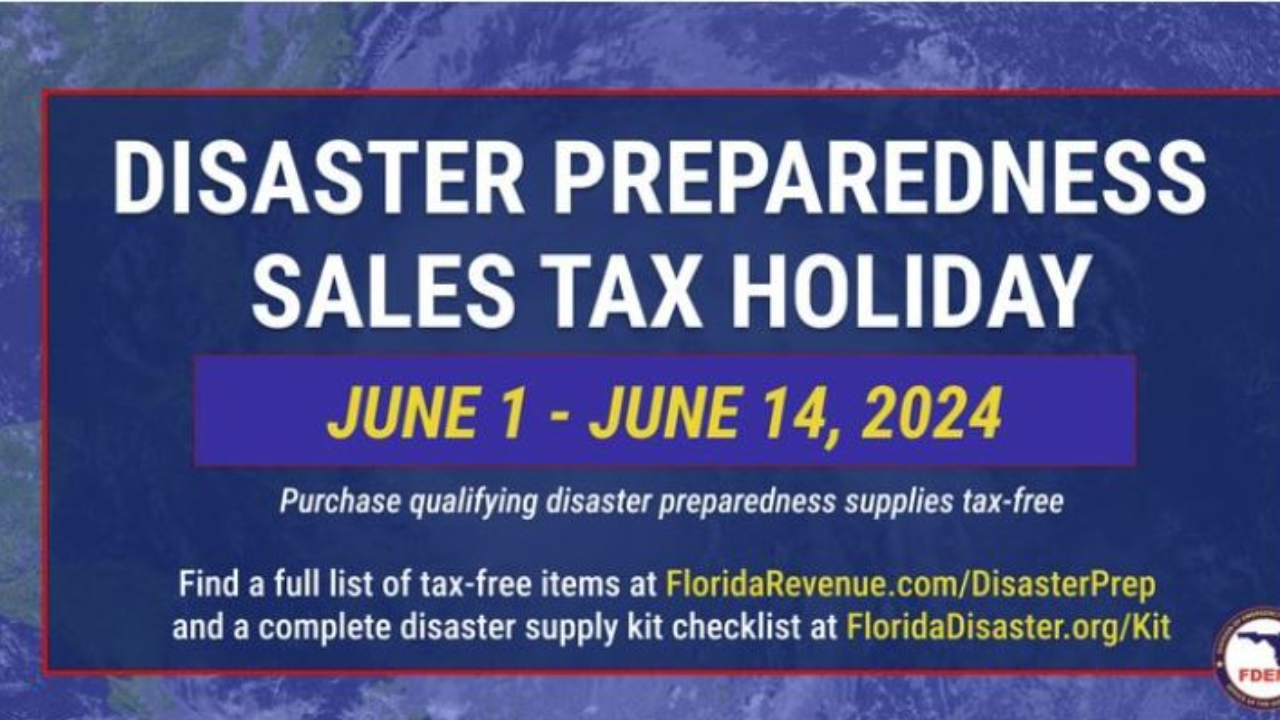

Florida, USA — Beginning Saturday, June 1, Floridians can start preparing for the upcoming hurricane season with the commencement of the 2024 Florida Disaster Preparedness Sales Tax Holiday. Running until Friday, June 14, this tax holiday presents an invaluable opportunity for residents to equip themselves with essential storm-related supplies without incurring any additional sales tax.

As hurricanes pose a significant threat to Florida each year, this tax holiday serves as a proactive measure to encourage preparedness and ensure the safety and well-being of individuals and communities across the state. With the official start of hurricane season coinciding with the launch of the tax holiday, it underscores the urgency and importance of readiness in the face of potential disasters.

The list of discounted items available during this tax holiday encompasses a wide range of essentials, catering to various aspects of disaster preparedness. From portable generators capable of providing crucial power supply during outages to tarps and waterproof sheeting for emergency shelter and protection, the assortment of eligible items empowers residents to fortify their homes and safeguard their families against the adverse effects of severe weather events.

Moreover, the inclusion of pet-related items underscores the holistic approach to disaster preparedness, recognizing the integral role that pets play in the lives of many individuals and families. Portable pet kennels, dry pet food, and over-the-counter medications ensure that beloved furry companions are also adequately cared for during times of crisis, fostering resilience and unity within households facing adversity.

In addition to addressing immediate needs, the tax holiday promotes long-term resilience by encouraging investment in safety equipment such as smoke detectors, fire extinguishers, and carbon monoxide detectors. These preventive measures not only mitigate the risk of harm during emergencies but also contribute to overall household safety and well-being beyond the scope of hurricane season.

Furthermore, the availability of discounted prices on essential supplies alleviates financial burdens for families and individuals, particularly those with limited resources. By removing sales tax on designated items, the tax holiday enhances accessibility and affordability, ensuring that preparedness remains within reach for all segments of the population, irrespective of socioeconomic status.

The 2024 Florida Disaster Preparedness Sales Tax Holiday exemplifies the state government’s commitment to proactive disaster management and community resilience. By empowering residents with the tools and resources needed to weather the storm, both figuratively and literally, Florida takes a proactive stance in mitigating the impact of natural disasters and safeguarding the well-being of its citizens.

Read More: Florida’s New Law Paves the Way for Enhanced Home Health Services!

Florida’s Top Court Says Police Can Make You Get Out of Your Car During a Traffic Stop!

Tragedy Strikes: Migrant Community Mourns Loss After Fatal Manhattan Incident!

As residents make preparations and stock up on supplies during this tax holiday, they not only enhance their own resilience but also contribute to the collective resilience of communities statewide. In the face of uncertainty, preparedness is paramount, and initiatives like the Disaster Preparedness Sales Tax Holiday play a pivotal role in fostering a culture of readiness and resilience across the Sunshine State.

+ There are no comments

Add yours