New York’s Staten Island — Many people are asking if another stimulus check is imminent after the election of former President Donald Trump, who will take over the White House in January. Trump has already issued two during his first term in office.

Millions of Americans depended on economic impact payments, also known colloquially as stimulus checks, from the federal government during the peak of the coronavirus (COVID-19) pandemic to make ends meet during a period when many were laid off.

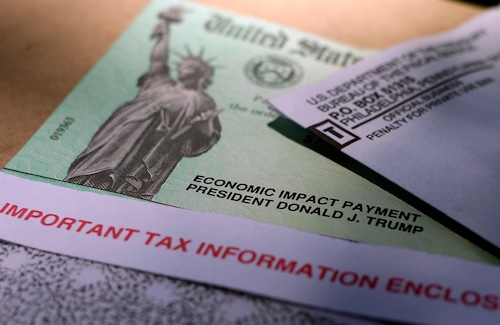

During his first term, Trump issued two such checks, the first for up to $1,200 in March 2020 and the second for up to $600 in December 2020.

As mandated by the American Rescue Plan Act, the Internal Revenue Service (IRS) under President Joe Biden made the last payments in 2021 in the form of $1,400 cheques.

According to the outbreak Response Accountability Committee, the government made over 476 million payments during the outbreak, which came to almost $814 billion.

Many Americans are still having financial difficulties and would appreciate a financial boost from the federal government, even if the pandemic has passed and is no longer preventing the majority of Americans from working.

However, according to a recent New York Post report, Trump does not seem to be prioritizing another round of stimulus checks as he gets ready for his second term.

The paper points to the 2008 financial crisis and the coronavirus epidemic as examples of how stimulus cheques have traditionally only been given out in cases of national emergency that pose a threat to the economy.

Furthermore, since Republicans who are leery of free handouts are poised to seize control of the Senate and House of Representatives in the upcoming year, the New York Post observes that there is little desire among federal lawmakers to support yet another round of checks and balances.

Some states are seeking different methods to help put money back in the pockets of their residents through tax credits, even though it is unlikely that Americans would receive any direct financial support from the federal government in the coming year.

Now offered in 15 states, including New York, where the program was recently extended to include children under four, child tax credits assist families in defraying the costs of raising children.

Note: Every piece of content is rigorously reviewed by our team of experienced writers and editors to ensure its accuracy. Our writers use credible sources and adhere to strict fact-checking protocols to verify all claims and data before publication. If an error is identified, we promptly correct it and strive for transparency in all updates, feel free to reach out to us via email. We appreciate your trust and support!

+ There are no comments

Add yours