WHITE PLAINS – In a significant case of medical professionals crossing ethical boundaries, Dr. Paul Feldman, a kidney specialist with practices in Poughkeepsie, Newburgh, and Kingston, was sentenced to federal prison for his involvement in a multimillion-dollar insider trading scheme. The sentencing, handed down on Tuesday, has drawn considerable attention due to the high-profile nature of the individuals involved and the substantial financial gains illicitly procured through their actions.

Dr. Feldman, who operated under the banner of Advanced Kidney Care, will serve six months at the Otisville Federal Correctional Facility. His involvement in the scheme marks a troubling intersection of healthcare and financial malfeasance, shaking the trust of patients and the public place in medical professionals.

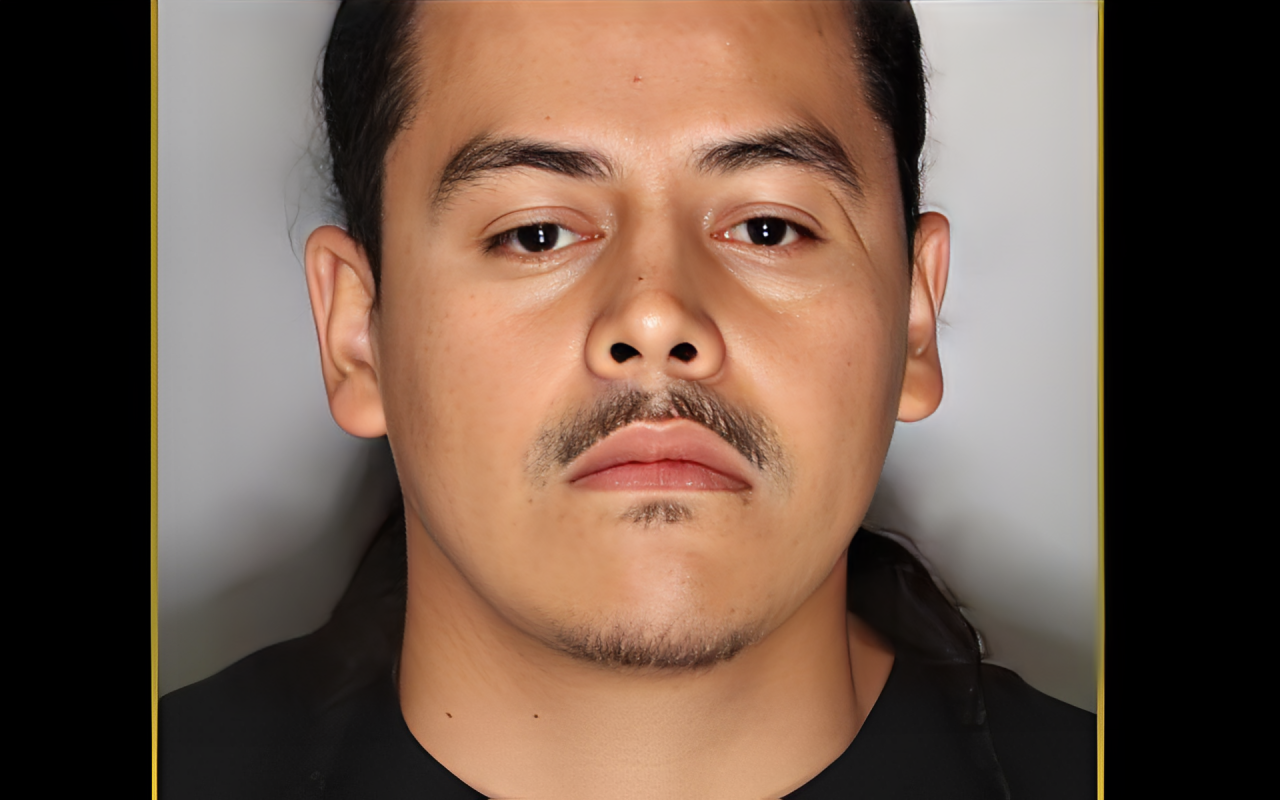

The roots of this scandal trace back to Feldman’s relative, Dr. Slava “Stanley” Kaplan, a pulmonologist formerly employed at Vassar Brothers Medical Center in Hopewell Junction. Kaplan, 45, was implicated as a central figure in the insider trading network. Last summer, federal prosecutors charged Kaplan with securities fraud, to which he pled guilty in September. His sentence, five months in federal prison, was finalized in January.

Both Feldman and Kaplan had established careers at Vassar Brothers, where they were colleagues. Their professional relationship became entangled with illegal activities when they engaged in insider trading involving Alexion Pharmaceuticals Inc. The core of the scheme revolved around privileged information about a merger between Alexion and Portola Pharmaceuticals, which had not yet been publicly disclosed.

Joseph Dupont, an executive at Alexion Pharmaceuticals, played a pivotal role by leaking insider information to a friend. This friend subsequently shared the confidential details with Kaplan, who then brought Feldman and others into the fold. Armed with this non-public information, they purchased Alexion shares at a low price, anticipating the significant profit surge that would follow the public announcement of the merger. Their actions led to substantial financial gains once the stock prices skyrocketed post-announcement.

Federal authorities identified that the scheme yielded approximately $4 million in illegal profits, distributed among Kaplan, Feldman, and other conspirators. The investigation and subsequent prosecutions highlight the serious repercussions of exploiting insider information for financial gain.

Feldman and Kaplan’s sentencing has not only resulted in their professional downfall, including the loss of their jobs at Vassar Brothers but also serves as a stark reminder of the legal and ethical boundaries that professionals in any field must adhere to. The case underscores the importance of maintaining integrity and the severe consequences of breaching legal and moral codes.

Moreover, this scandal has broader implications for the medical community and the pharmaceutical industry, emphasizing the need for stringent safeguards against insider trading and other forms of financial misconduct. As the details of this case continue to resonate, it becomes evident that upholding ethical standards is paramount in preserving public trust in both healthcare and financial markets.

Read More: NYPD Crime: Armed Man Struck by Unmarked Police Car in Brownsville!

Detectives Crime Clinic Honors Arteta and Hoovler with Prestigious Awards!

Dr. Feldman’s journey from a respected nephrologist to a convicted felon serves as a cautionary tale of how ethical lapses can lead to severe personal and professional repercussions. His upcoming time in Otisville Federal Correctional Facility marks a period of accountability, as he pays the price for his involvement in a scheme that tarnished his career and compromised the ethical foundations of his profession.

+ There are no comments

Add yours